In today’s globalized world, transferring money across borders has become a necessity, especially for expatriates who live and work in the United Arab Emirates (UAE). The UAE is home to millions of expatriates, many of whom regularly send money to their home countries to support their families. Whether it’s for personal needs, business purposes, or investments, understanding how UAE money transfer works is essential for ensuring smooth, cost-effective transactions.

What Is Money Transfer?

Money transfer refers to the process of sending funds from one location to another, typically through a bank, money transfer service, or an online platform. In the UAE, there are several methods available to transfer money both within the country and internationally. The key elements of any money transfer process include the amount to be transferred, the recipient’s details, and the medium through which the transfer is made.

Money transfers in the UAE are facilitated through various channels including banks, money transfer operators (such as Western Union and MoneyGram), and digital wallets. These services ensure that individuals can send and receive money in a fast and secure manner.

Importance of Money Transfer in the UAE

The UAE’s economy is largely supported by its expatriate workforce, which makes money transfer an integral part of the country’s financial ecosystem. Expats send millions of dirhams home each year, contributing to the economy of their home countries and ensuring the well-being of their families. Whether it’s for education, healthcare, or daily living expenses, these remittances play a crucial role in improving the quality of life in many countries.

Understanding the best way to send money from the UAE can help you save on transfer fees and ensure that the funds reach the recipient without any delays.

Types of Money Transfer Services in the UAE

There are various types of money transfer services available in the UAE, each catering to different needs. The most common options are:

Bank Transfers

Banks in the UAE offer a reliable way to transfer money domestically and internationally. Most banks provide multiple channels for transfers, such as mobile apps, internet banking, and over-the-counter services. Bank transfers are ideal for individuals who prefer traditional, secure means of transferring money. However, the process can be slightly more expensive compared to other methods, especially when it comes to international transfers due to higher fees and less favorable exchange rates.

Money Transfer Operators (MTOs)

Money transfer operators like Western Union, MoneyGram, and UAE Exchange are popular among expatriates due to their speed and convenience. These services allow individuals to send money across borders, usually within minutes, making them perfect for urgent transfers. Most MTOs have extensive global networks, making it easy to send money to almost any country. Additionally, some operators offer digital platforms that allow you to send money without needing to visit a physical branch.

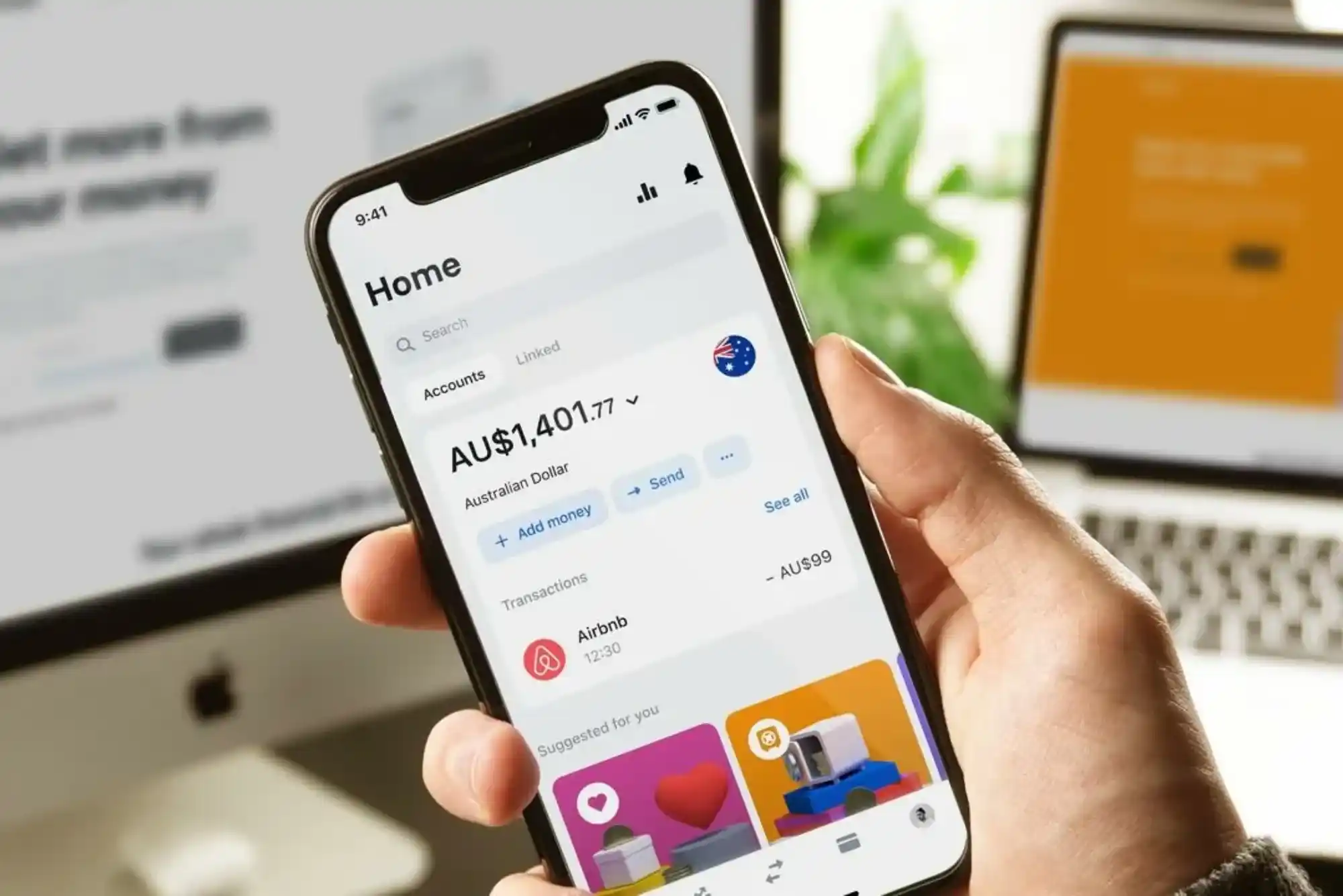

Digital Wallets and Online Platforms

With the rise of digital technology, online money transfer platforms such as PayPal, TransferWise, and Skrill have become popular for UAE money transfer. These platforms offer fast, low-cost services with competitive exchange rates. The advantage of using digital wallets is the convenience of transferring money from your smartphone or computer. Some of these platforms also offer additional features such as currency exchange and investment options.

Factors to Consider When Choosing a Money Transfer Service

When selecting a money transfer service in the UAE, there are several important factors to keep in mind:

Transfer Fees

The fees charged by different services can vary significantly. Some services offer free transfers for certain amounts, while others charge a flat fee or a percentage of the transfer amount. It’s important to compare fees across different providers to ensure you get the best deal.

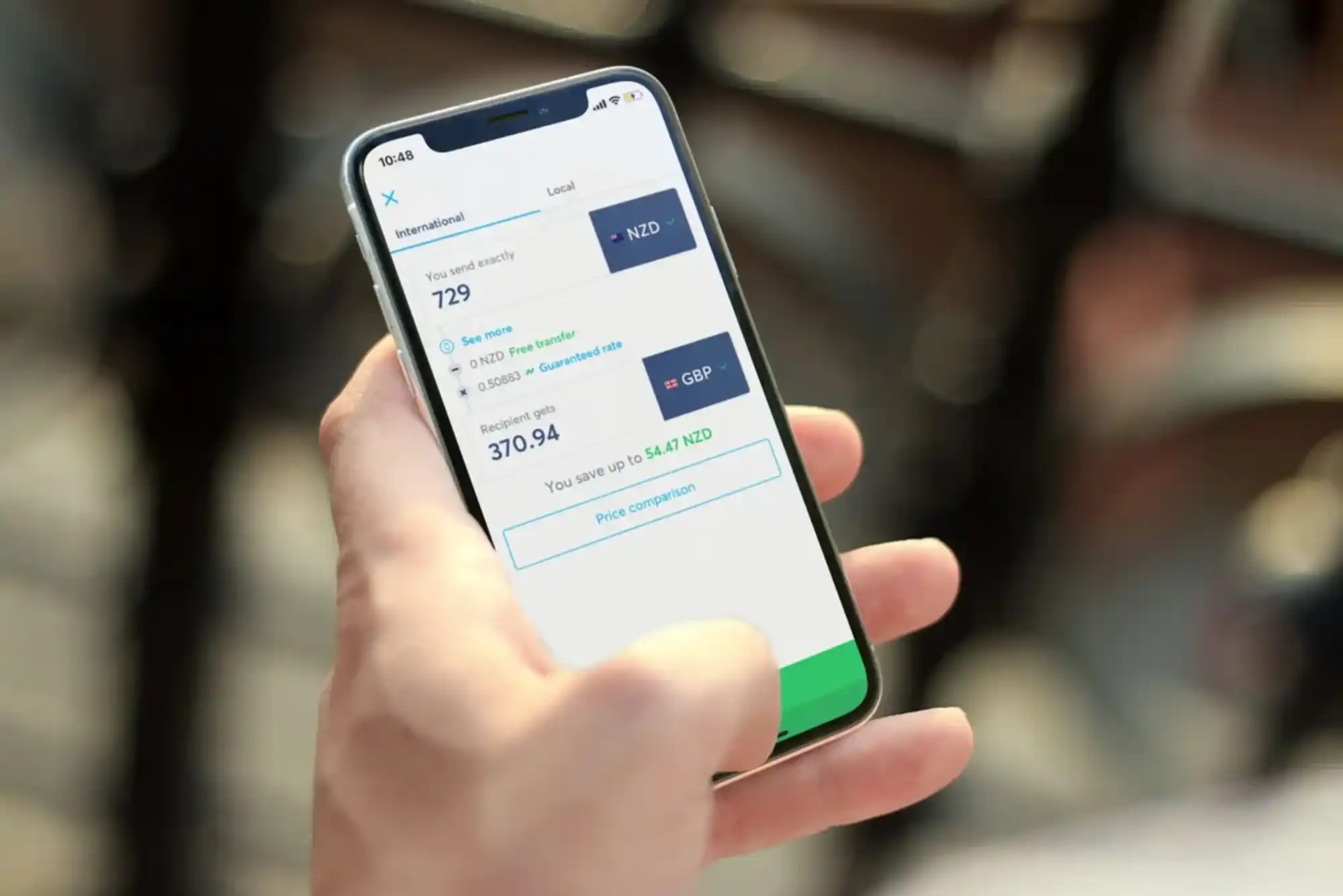

Exchange Rates

Exchange rates can make a big difference in the amount of money the recipient receives. Banks often offer less favorable rates compared to money transfer operators or online platforms. Before making a transfer, check the current exchange rate and choose a service that offers competitive rates.

Transfer Speed

Some services provide instant transfers, while others can take a few days. The speed of the transfer depends on factors such as the destination country, the method of transfer, and the service provider. If you need to send money urgently, it’s best to choose a service that offers same-day or next-day transfers.

Security

Security is a top concern when it comes to money transfers. Reputable money transfer services use encryption and other security measures to ensure that your money and personal information are protected. Always choose a licensed and regulated service to avoid any risk of fraud.

Transfer Limits

Most services have minimum and maximum transfer limits. If you need to transfer a large sum of money, make sure the service you choose can accommodate your needs. Some services offer special rates or lower fees for high-value transfers.

Steps to Transfer Money in the UAE

Transferring money in the UAE is a straightforward process. Here’s a step-by-step guide:

Choose a Service Provider

First, decide on the service provider based on the factors mentioned above. Whether you prefer a traditional bank, an MTO, or a digital wallet, make sure to choose one that meets your needs.

Register an Account

Most money transfer services require you to create an account. This process usually involves providing your personal details and verifying your identity.

Enter the Recipient’s Details

You’ll need to provide information about the recipient, including their name, address, and banking information if you’re sending money to their bank account. If you’re using an MTO, you can often choose to send the money for cash pick-up.

Choose the Transfer Amount and Method

Select the amount you want to send and the method of transfer. Some services allow you to choose whether to pay from your bank account, debit card, or credit card.

Confirm the Transfer

Before completing the transfer, review the details to make sure everything is correct. Once confirmed, the money will be sent to the recipient. Depending on the service and destination, the transfer can take anywhere from a few minutes to several days.

Popular Destinations for Money Transfers from the UAE

The majority of expatriates in the UAE come from countries like India, Pakistan, the Philippines, Egypt, and Bangladesh. These countries are the top destinations for UAE money transfer, with billions of dirhams being sent annually.

India

India is the top destination for remittances from the UAE, with millions of Indian expatriates sending money back home for family support, investments, and savings. Transfers to India are facilitated by a wide range of services, offering competitive rates and fast transfers.

Pakistan

Many Pakistani expatriates in the UAE rely on money transfer services to send remittances to their families. Popular methods include bank transfers and MTOs such as Western Union and MoneyGram.

Philippines

The Philippines is another major recipient of remittances from the UAE. Filipino workers often use MTOs and online platforms to send money back home for daily expenses and education.

Future of Money Transfer in the UAE

As technology continues to evolve, the future of money transfer in the UAE looks promising. Digital wallets and blockchain technology are expected to play a bigger role in making international transfers faster, cheaper, and more secure. The introduction of new regulations aimed at protecting consumers and improving the efficiency of transfers will also contribute to a better experience for users.

Additionally, the UAE government is encouraging the development of fintech solutions to ensure that the country remains at the forefront of global financial innovation. As a result, more individuals will have access to cutting-edge solutions for transferring money quickly and safely.

The process of UAE money transfer is crucial for expatriates looking to send money to their home countries. With numerous options available, including traditional bank transfers, MTOs, and digital wallets, it’s important to choose the service that best suits your needs. By considering factors such as transfer fees, exchange rates, and security, you can ensure that your money reaches its destination quickly and efficiently. As the financial landscape continues to evolve, the future of money transfers in the UAE looks bright, with new technologies set to make the process even more convenient for users.