Cryptocurrencies have captured the imagination of investors worldwide, emerging as a disruptive force in the financial landscape.

Powered by blockchain technology, these digital assets offer promises of decentralization, security, and potentially lucrative returns. However, amidst the fervor surrounding cryptocurrencies, investors are left pondering a critical question: Are cryptocurrencies truly a good investment option?

Understanding Cryptocurrencies

At their core, cryptocurrencies are digital or virtual currencies that utilize cryptography for secure transactions and operate on decentralized networks called blockchains. Bitcoin, the first and most well-known cryptocurrency, introduced the world to blockchain technology.

Since then, thousands of alternative cryptocurrencies, often referred to as altcoins, have entered the market, each with its unique features and use cases.

The value of cryptocurrencies is primarily determined by supply and demand dynamics, with factors such as adoption rates, technological developments, regulatory trends, and market sentiment influencing their prices.

Pros of Investing in Cryptocurrencies

One of the most compelling arguments for investing in cryptocurrencies is the potential for significant returns. Bitcoin’s remarkable ascent from obscurity to mainstream acceptance has minted millionaires and sparked a frenzy of interest in the digital asset space.

Additionally, cryptocurrencies offer diversification benefits, as they are uncorrelated with traditional financial markets such as stocks and bonds.

Furthermore, they serve as catalysts for innovation, fostering the development of decentralized applications (dApps) and smart contracts that have the potential to revolutionize industries ranging from finance to supply chain management.

Risks and Challenges

Despite their potential rewards, investing in cryptocurrencies carries substantial risks. Price volatility is a defining characteristic of the crypto market, with prices capable of experiencing dramatic swings within short timeframes.

Regulatory uncertainty poses another significant risk, as governments worldwide grapple with how to classify and regulate cryptocurrencies. Security concerns also loom large, with incidents of hacking, fraud, and theft eroding investor confidence.

Moreover, the environmental impact of cryptocurrency mining, particularly for proof-of-work cryptocurrencies like Bitcoin, has raised ethical and sustainability concerns.

Factors to Consider Before Investing

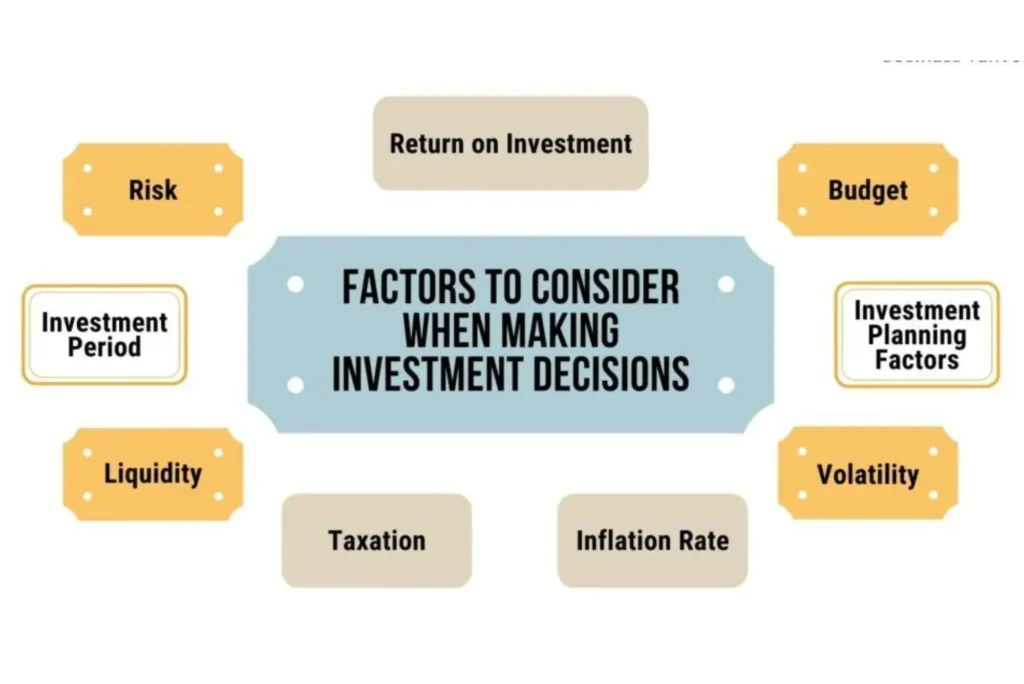

Before diving into the world of cryptocurrency investment, individuals should carefully evaluate several key factors. Firstly, understanding one’s risk tolerance, investment goals, and time horizon is essential in determining whether cryptocurrencies align with one’s financial objectives.

Thorough research into individual cryptocurrencies, including their underlying technology, use cases, and development teams, is paramount. Additionally, staying abreast of market trends, regulatory developments, and geopolitical events can provide valuable insights into potential investment opportunities and risks.

Seeking advice from financial professionals with expertise in cryptocurrencies can also help investors navigate the complexities of this evolving asset class.

Risk Tolerance and Investment Goals

Before diving into the world of cryptocurrency investment, it’s crucial to assess your risk tolerance and investment objectives. Cryptocurrencies are known for their price volatility, which can lead to significant fluctuations in investment value over short periods.

Consider whether you’re comfortable with the potential for both sizable gains and losses in your investment portfolio. Additionally, clarify your investment goals—are you seeking short-term profits, long-term growth, or perhaps looking to hedge against inflation?

Understanding your risk appetite and financial objectives will help inform your cryptocurrency investment strategy.

Research and Due Diligence

Thorough research is paramount when considering investing in cryptocurrencies. Take the time to educate yourself about the various cryptocurrencies available, their underlying technology, use cases, and development teams.

Explore whitepapers, project websites, and community forums to gain insights into the potential value and viability of different cryptocurrencies.

Pay special attention to factors such as the technology’s scalability, security features, and adoption potential. For example, the value of Pi cryptocurrency, which aims to create a more inclusive digital currency accessible to all, can be better understood through in-depth research into its technology and community ecosystem.

Market Analysis and Trends

Keeping abreast of market trends and developments is essential for making informed investment decisions in the cryptocurrency space. Monitor price movements, trading volumes, and market sentiment indicators to identify potential entry and exit points.

Analyze historical price data and market cycles to gain insights into potential future trends. Additionally, stay informed about regulatory developments, technological advancements, and industry news that may impact cryptocurrency markets.

By staying ahead of the curve, you can position yourself to capitalize on emerging opportunities and mitigate risks effectively.

Regulatory Environment and Legal Considerations

The regulatory landscape surrounding cryptocurrencies varies from country to country and is constantly evolving. Before investing in cryptocurrencies, it’s essential to understand the regulatory environment in your jurisdiction and any legal considerations that may apply.

Some countries have embraced cryptocurrencies, providing clear regulatory frameworks and fostering innovation in the sector. Others have taken a more cautious approach, imposing restrictions or outright bans on cryptocurrency-related activities.

Familiarize yourself with relevant laws, taxation policies, and compliance requirements to ensure that your investments comply with regulatory standards and minimize legal risks.

Technical Analysis and Risk Management

Technical analysis involves examining price charts and using statistical tools to identify patterns and trends in cryptocurrency markets.

By conducting technical analysis, investors can make informed decisions about when to buy, sell, or hold their cryptocurrency holdings. Additionally, implementing risk management strategies, such as setting stop-loss orders and diversifying your investment portfolio, can help mitigate potential losses and preserve capital.

Remember that risk management is an integral part of successful investing and should be incorporated into your cryptocurrency investment strategy.

By carefully considering these factors—risk tolerance, research, market analysis, regulatory environment, and risk management—you can make informed decisions about whether and how to invest in cryptocurrencies.

Whether you’re drawn to the potential for high returns, the technological innovation, or the ethos of decentralization, approaching cryptocurrency investment with diligence and discernment can help you navigate the complexities of this dynamic asset class.

And as you explore opportunities in the cryptocurrency market, don’t forget to delve into the value proposition of Pi cryptocurrency, a project striving to redefine digital currency accessibility and inclusivity for all.

Case Studies and Examples

Examining past experiences can offer valuable lessons for prospective cryptocurrency investors. Success stories abound, with early adopters of Bitcoin and other cryptocurrencies reaping extraordinary gains.

However, cautionary tales of failed projects, fraudulent schemes, and devastating losses serve as sobering reminders of the risks inherent in the crypto market.

From the meteoric rise and subsequent collapse of ICOs (Initial Coin Offerings) to the infamous Mt. Gox exchange hack, historical events underscore the importance of due diligence and risk management in cryptocurrency investing.

Expert Opinions and Perspectives

Financial analysts, industry experts, and thought leaders offer a spectrum of viewpoints on the viability of cryptocurrencies as an investment asset. While some view cryptocurrencies as a speculative bubble destined to burst, others see them as a transformative force that will reshape the global financial system.

Proponents argue that cryptocurrencies represent a hedge against inflation, censorship-resistant store of value, and a means of financial inclusion for the unbanked population.

Skeptics, on the other hand, raise concerns about regulatory scrutiny, technological limitations, and the proliferation of scams and Ponzi schemes in the crypto space. By considering diverse perspectives and weighing the evidence, investors can make informed decisions about incorporating cryptocurrencies into their investment portfolios.

The question of whether cryptocurrencies are a good investment is multifaceted and subjective. While cryptocurrencies offer the potential for substantial returns and technological innovation, they also present significant risks and uncertainties.

As with any investment opportunity, individuals should approach cryptocurrency investing with caution, conducting thorough research, managing risk appropriately, and seeking professional advice when needed.

By staying informed, remaining vigilant, and exercising prudence, investors can navigate the cryptocurrency investment landscape and potentially capitalize on the opportunities presented by this dynamic asset class.